Private equity has become hyper-competitive. With abundant liquidity and highly structured processes, new levers to drive value growth and differentiation are needed. And higher inflation will only increase the pressure.

Humatica saw this wave coming and published ‘The Third Wave’ in 2015. Back then, we anticipated the rise in Organizational Effectiveness as a new and complex value creation lever. Our predictions seven years ago proved correct as evidenced by an increasing number of specialist “Talent Operating Partners” and greater focus on governance quality. But there is far further to go.

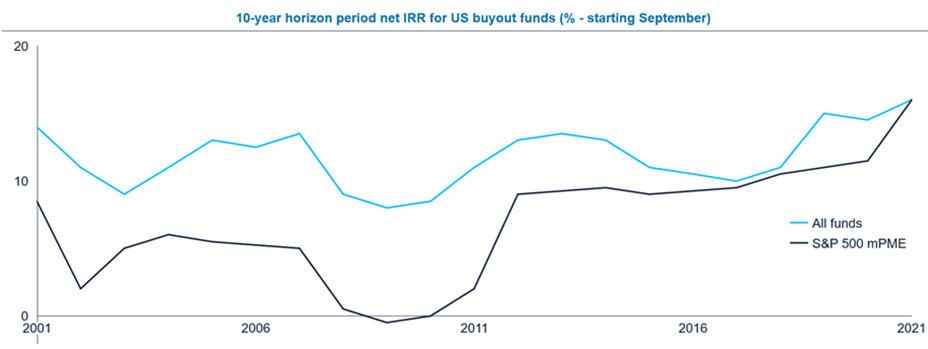

The risk-adjusted returns of private equity are starting to sputter compared to other alternatives. According to Bain & Co. liquid investments in the S&P500 yielded similar returns to US buyout funds over the last few years. After the first wave of financial engineering and the second wave of operational excellence, which are both now priced-in, General Partners (GPs) need new ways to create value and differentiate in the eyes of Limited Partners.

By focusing on Organizational Excellence, as the third and most complex lever, fund managers can accelerate operational excellence and sustained value growth in an increasingly turbulent market environment.

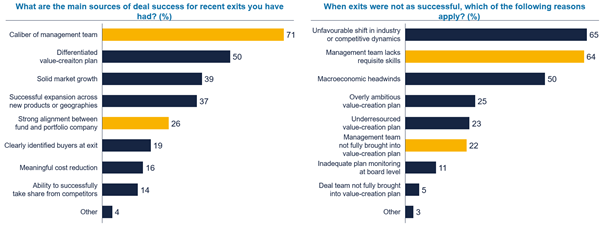

Organizational Excellence focuses on improving “soft” factors like culture, behaviors and management processes that sponsors are aware of, but struggle to properly address. When asked what are the main drivers of deal success and failure, fund managers ranked soft-factors at the top. They include calibre and fit of the management team and alignment between the portfolio company and sponsor (Figure 2 & 3).

As the realization that the organization and its collective ability to drive continuous adaptation are the ultimate source of sustainable value creating sinks in, more focus is turning to Organizational Excellence. A reliable leadership team, a good CEO, a high-performance culture, sound KPIs and mature management processes, a strong middle management bench, and a knowledgeable and capable workforce are all factors that differentiate between good and great investment returns. But, organizations are very complex, with many diverse and subtle drivers of performance. And, you are only as good as your weakest link. With a lack of codified management processes and best-practice behaviors, private equity sponsors are struggling to decipher how to address Organizational Excellence in a pragmatic way.

Our next series of articles, podcasts and webinars revisits our Third Wave Study findings to address four key elements to achieve Organizational Excellence:

We explore why these elements are critical for accelerating and de-risking full potential plan implementation. And, we provide pragmatic best practices that can be applied to tackle them.

The private equity (PE) playbook is evolving. Rapid buy-and-sell cycles are giving way to continuation vehicles and longer hold periods, demanding a new approach to…

Read more

The private equity landscape continues to evolve, influenced by macroeconomic shifts and emerging trends. The ecosystem is becoming increasingly polarized, with firms gravitating towards either…

Read more

Why is it that most mergers, reorganizations, and downsizings fail to generate their anticipated full value? The main reason is that a lack of effective…

Read moreReceive our news and valuable perspectives on organizational effectiveness each month.