28 Nov, 2025 By Humatica

Expert commentary and insights on activating organizations for entrepreneurial business leaders and private equity sponsors.

View News

Unpacking the root causes behind underperformance and how to resolve them It’s a familiar scene: Over dinner, a client lamenting inconsistent results across their portfolio…

Read more

Alpha Talks: Getting the operating model right as a complex carve-out CEO | Jon Newhard, Yunex Traffic CEO In this episode of Humatica Alpha Talks,…

Read more

CEO Succession: How to avoid the pitfalls and unlock the value Poorly managed CEO and C-suite transitions in the S&P 1500 companies are estimated to…

Read more

Continuation Funds Surge Continuation fund transactions surged to $63 billion in 2024, driven by a liquidity drought that left 29,000 unsold portfolio companies globally, valued…

Read more

Scaling has become a favorite private equity buzzword. It shows up in nearly every deal thesis, investment committee, and boardroom conversation. Scaling is the fulcrum…

Read more

With a record number of portcos being held and sluggish deal markets, private equity is sharpening its focus on operational resilience. Current macro-economic and geopolitical…

Read more

The Economics of AI Disruption The story of AI is not about tools — it’s about economics. AI collapses interface costs, compresses overhead, and enables…

Read more

Firsthand strategies from portfolio company CEO’s who outperformed in uncertain times Portfolio company leaders are facing bigger challenges than ever before. Unprecedented macro-headwinds from increased…

Read more

With interest rates at levels not seen in over a decade, the private equity model has entered a new phase—one where operational excellence is no…

Read more

Resilience isn’t a buzzword anymore—it’s the make-or-break factor for portfolio companies navigating today’s volatility. That was the takeaway from the standout panel at the PE…

Read more

Rightsizing an organization is never easy. But, it is a normal process as firms adapt to changing market requirements. More recently, higher interest rates, AI…

Read more

The promise of AI and turbulence introduced by the Trump tariffs have renewed focus on rightsizing and efficiency improvement as levers for value creation and…

Read more

The private equity (PE) playbook is evolving. Rapid buy-and-sell cycles are giving way to continuation vehicles and longer hold periods, demanding a new approach to…

Read more

The private equity landscape continues to evolve, influenced by macroeconomic shifts and emerging trends. The ecosystem is becoming increasingly polarized, with firms gravitating towards either…

Read more

Why is it that most mergers, reorganizations, and downsizings fail to generate their anticipated full value? The main reason is that a lack of effective…

Read more

As the traditional levers of value creation get price-in, getting a competitive edge in private equity lies in unlocking hidden potential within portfolio companies through…

Read more

According to the most recent federal statistics, business bankruptcy filings surged by 33% in the US between September 2023 and September 2024. Elevated debt, higher supplier costs,…

Read more

CEOs envisioning a new organizational structure often face a daunting question: how do I bring this vision to life across my organization? The stakes are…

Read more

Private Equity thrives on unlocking value in portfolio companies through governance improvements and strategic interventions. Yet, as economic and market complexities increase, the challenge of…

Read more

Despite huge efforts to improve operational processes over the past 20 years, critically important management processes are left up to the discretion of each manager…

Read more

The global economy in 2024 resembles a rollercoaster more than ever before. Geopolitical tensions, technological disruptions, and shifting consumer behaviours have created a perfect storm…

Read more

In the bustling world of Silicon Valley and beyond, a new paradigm is stirring up debate: “Founder Mode” vs “Manager Mode”. Paul Graham, co-founder of…

Read more

In today’s rapidly evolving private equity landscape, the pressure on sponsors and management to accelerate post-acquisition change has never been greater. With rising asset prices…

Read more

Executive Leadership Assessment plays a key role in private equity investments, serving as a important determinant of organizational effectiveness and the success or failure of…

Read more

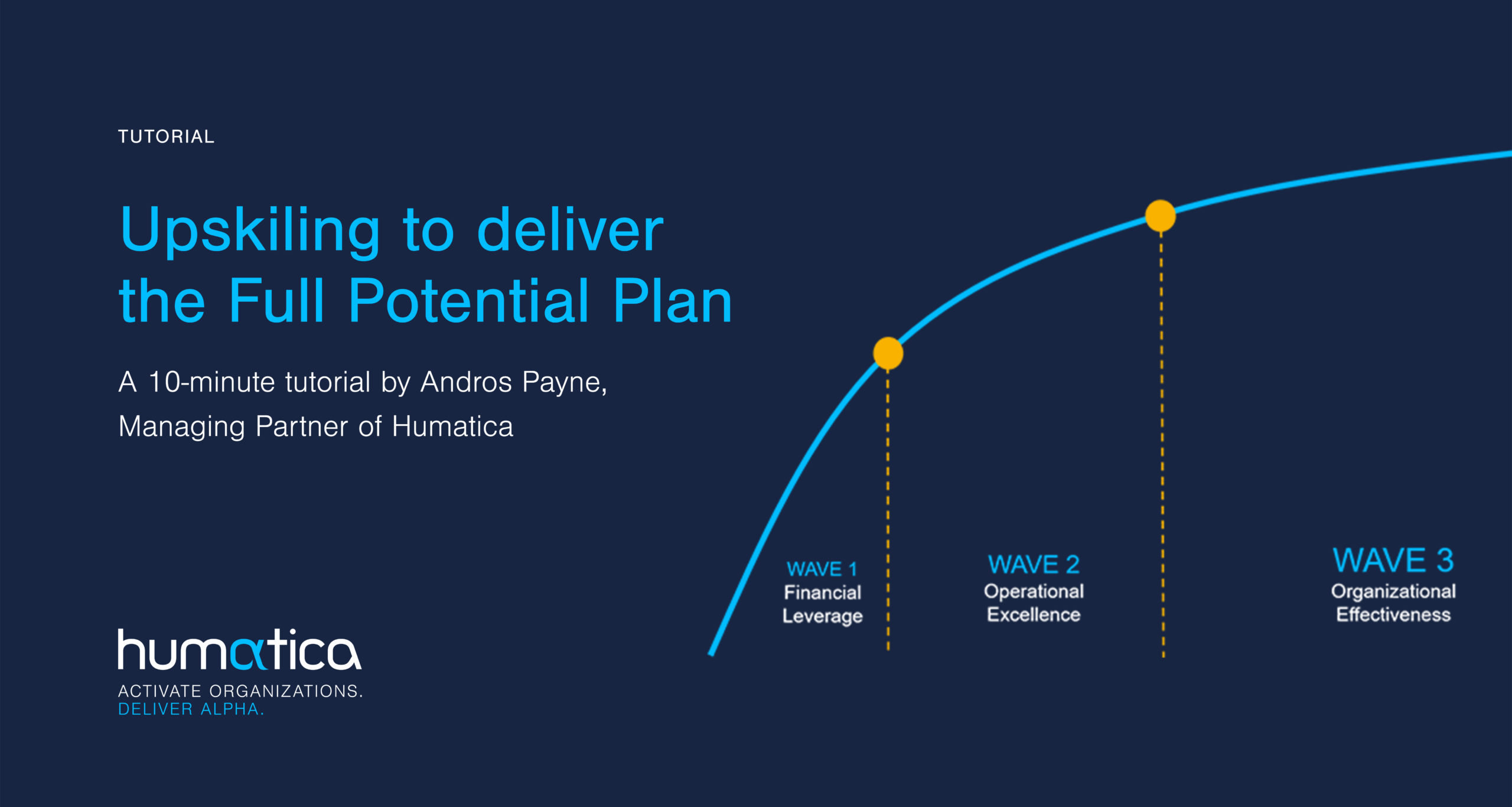

Funds need to squeeze more free cash flow from companies in order to generate an adequate return from vintage 2019-2022 investments. More sales growth and/or…

Read more

The fund landscape is changing faster than ever before, creating winners and losers in an increasingly competitive private equity ecosystem. Higher real interest rates are…

Read more

In the third episode of our Beyond Culture Series, we talk about industrializing best practice management processes. Link to Video 1:07 Register here to join our live…

Read more

There’s increasing focus on “culture” as an elusive driver of value growth. Creating a “high performance culture” has become the mantra for transforming buy-outs to…

Read more

The second installment of our interactive webcasts looks at organizational transformation. Join us for a lively discussion on this topic of vital interest for private equity.…

Read more

Alvin Toffler’s 1970 global best seller “Future Shock” described the disruptive impact of new technologies on business and society. His title is even more applicable…

Read more

“What got you there won’t get you there”. It’s never been more true than right now for private equity backed companies facing economic headwinds. Increasing…

Read more

Welcome to an exciting journey of discovery as we delve into the intricacies of organizational effectiveness in our latest podcast & video series, “Beyond Culture.”…

Read more

RealDeals Value Creation Conference added a second day this year to focus on organizational effectiveness and talent as a key driver of value creation. The…

Read more

Humatica founder, Andros Payne, explains the importance of organizational effectiveness to Ross Butler in a recent FundShack interview. It’s an opportunity to learn how to…

Read more

Information asymmetry in dealmaking has favoured incumbent management teams over investors, especially with culture and leadership practices. Managers may know where these skeletons are buried…

Read more

In private, talent operating partners are frustrated with investment teams lack of understanding about organizations. Likewise, investment managers are frustrated that they can’t find the…

Read more

Operating Partners from 20 top funds recently met to discuss how to align managers and employees to deliver the value creation plan. Humatica facilitated the…

Read more

Conventional wisdom says that building on the strengths of an organisation is the most direct path to business success. It’s also the foundation of most…

Read more

Talent Operating Partners are playing an increasingly critical role for value creation at the current inflection point for the PE industry where “what got you…

Read more

In today’s dynamic business landscape, private equity (PE) firms are increasingly searching for deals across a range of sectors and industries. Competition for investments is…

Read more

Private Equity International (PEI) held its second annual Operating Partners Human Capital Forum in central Manhattan. The biggest take-away from this event is that it…

Read more

Companies are reorganising more frequently than ever before. It’s a natural consequence of a more dynamic market environment. But how can they manage the risks…

Read more

In a rare moment of frustration, mid-market investment manager Jan complained, “we agreed a full-potential plan with management. But now, a year in, implementation is…

Read more

Based on Humatica’s recent research, Organizational Effectiveness: Riding private equity’s third wave of value creation, this webinar examines why and how organizational effectiveness is being…

Read more

Elon Musk’s dramatic Reduction in Force at Twitter (affectionately known as “RIF” in the US) is both an early indication of more to come, and…

Read more

Edwards Deming, the father of modern-day statistical process control and Total Quality Management, understood that reducing sources of variability in business produces consistent results with…

Read more

As economic pressure mounts, more corporate carve-outs are on the cards. These primary buyouts have been lucrative for private equity. But they require more work…

Read more

On Thursday 3rd November, Humatica had the pleasure of sponsoring and attending the Real Deals Value Creation Conference. The full-day event benefitted from the participation…

Read more

More literature and advice is piling up on leadership effectiveness and organizational performance. It’s no surprise. We are at an inflection point between the industrial…

Read more

In the latest episode of the alpha Talks Podcast, Humatica Managing Partner Andros Payne speaks to Stijn Vos, CEO of the Esdec Solar Group and…

Read more

Assessing good governance is still in its infancy. The most common approaches are focused on interactions with the top-level board and senior executive. The state…

Read more

With multiples under pressure, buy-out managers are asked to do more to drive top-quartile performance. Entrepreneurial leaders know that they need to inspire and activate…

Read more

ESG and good Governance have become essential tools for sustainable value growth. But Governance in particular has proven elusive to measure. That’s a challenge because…

Read more

As much as a company with a good corporate culture can thrive even in difficult times, a firm with a dysfunctional culture can stumble in…

Read more

Corporate culture is a wonderfully fuzzy concept that is both liked and despised by investment professionals. They know culture is critically important, but don’t know…

Read more

The jury is now in, the Fed has been sleeping at the wheel and the genie is now out of the bottle. The annualized US…

Read more

Humatica has pioneered analytical tools and methods to open the black box around middle management readiness and ensure smooth implementation of the value creation plan.…

Read more

Limiting assessments to the N-1 top-executives risks miscalculating the capacity of the portfolio company’s organization to drive change. Often overlooked, middle management is the critical…

Read more

While traditional leadership assessments can be seen as complex, subjective and even threatening exercises, there are other simpler approaches that sponsors can use to a…

Read more

The information-age has brought the rise of “knowledge workers” as the key asset driving value growth – smart, self-motivated people who connect-the-dots and facilitate the…

Read more

The leadership team is a driving force for creating a high-performance culture and generating superior returns. Contrary to conventional wisdom, getting the right CEO is…

Read more

Why Organizational Excellence? Private equity has become hyper-competitive. With abundant liquidity and highly structured processes, new levers to drive value growth and differentiation are needed.…

Read more

Why is it that most mergers, reorganizations and downsizings fail to generate their anticipated full value? The main reason is a lack of good governance…

Read more

Companies are reorganizing more frequently than ever before. It’s a natural consequence of a more dynamic market environment and higher management turnover. Jack Welch famously…

Read more

It is a difficult role which first appeared ten years ago. Talent operating partners are a small cohort that goes by different names. However, they…

Read more

As the founder and Managing Partner of Humatica, it’s been a privilege to observe, and in a small way, facilitate the transformation of private equity…

Read more

How to profit from dynamic markets. Is your organization ready for it? Humatica’s Andros Payne was recently interviewed on the new frontier of behavior-centric business…

Read more

A chorus of top economists and investment gurus including Larry Summers, Ray Dalio, Nouriel Roubini, Jeremy Grantham, Cathy Wood and Mohamed El-Erian are sounding the…

Read more

Excess liquidity has flooded private markets and reduced the number of easy targets in private equity. Investors are now competing for ever smaller arbitrage opportunities…

Read more

In the new episode of the alpha Talks Podcast, Enno Krey speaks to Dr. Thomas Costa, former CEO of Coventya (acquired by MacDermid Enthone in…

Read more

A side-effect of full-priced markets and the industrialisation of private equity is funds looking to upgrade and standardize their deal processes – the way they…

Read more

Humatica Managing Partner Andros Payne interviews Joost Heeremans, Partner at Gilde Buy Out Partners, and Stijn Vos, CEO of ESDEC, about the lessons learned during…

Read more

In the latest episode of the alpha Talks Podcast, Enno Krey speaks to Jouni Heinonen, Managing Partner of HVD Partners, a service provider that helps…

Read more

Making good investment choices is getting harder With more institutional money in the market and the industrialization of private equity, the number of attractive opportunities…

Read more

The Practical Guide for Private Equity Professionals and Senior Executives Humatica’s latest whitepaper “Buy & Build: Secrets of Success” features the critical lessons learnt that…

Read more

The fund landscape is changing, creating more winners and losers in an increasingly polarised ecosystem. The pandemic and long-term megatrends are forcing strategic and competitive…

Read more

Once a top-level target operating model and organization are agreed, that’s when the heavy lifting starts. It’s when hundreds of decisions on sub-structures, new or…

Read more

Most managers and employees view a merger or acquisition with fear and suspicion. They see it as a zero-sum game, where one party wins at…

Read more

SPACs are a new phenomenon that further blurs the line between public and private markets. They are putting more pressure on private equity funds to…

Read more

Defining the post-merger operating model is an essential step after a bolt-on acquisition including what functions and activities should be merged, and which should not.…

Read more

What got you here, won’t get you there. With deal prices on the rise, funds need work harder and take bigger risk to realize superior…

Read more

Humatica recently interviewed Jouni Heinonen, the managing partner of HVD Partners on their sale of Solifos AG to NBG GmbH. HVD Partners carved out the…

Read more

Defining a target operating model “TOM” is an essential first step following a bolt-on acquisition. It sets the organizational framework for the future management structure…

Read more

One of the consequences of more competitive deal markets and more money in private equity is the increased use of consultants – not only pre-deal…

Read more

97% of deal makers agree that organizational issues are the greatest source of deal risk. Ask any dealmaker what determined their best and worst deals…

Read more

In an increasingly competitive deal market, private equity firms are more and more turning to Buy & Build strategies to realize superior returns on their…

Read more

Andros Payne has joined the first episode of the alpha Talks podcast. He speaks about organizational effectiveness and explains how private equity funds can use…

Read more

Private equity has consistently outperformed public markets. In the past this was attributed to more aggressive capital structures and strongly aligned management incentives. However, with…

Read more

Is your Sales Force ready for digital sales? As 2020 draws to a close, corporate leaders are looking back over the last months since COVID…

Read more

Humatica is featured in The Times of London on restructuring for future growth during COVID. The Raconteur supplement on Business Restructuring addresses key aspects on the…

Read more

It happens too often. Firms start an ERP implementation. After vendor selection and latest during process requirements definition, they realise that the new system will…

Read more

Even in COVID times, bolt-on acquisitions are an important lever of value growth for private equity. However, they are tricky to execute, especially with former…

Read more

COVID-19 is causing unprecedented upheaval in the travel industry. In particular, business travel has seen a steep decline driven by lockdown constraints and the emergence…

Read more

Sponsors pull their hair out trying to reform the governance of previously family-run businesses. Clearly, there are many successful ones, including Swarovski, Mars and ALDI.…

Read more

Clive Booth of the ESG Foundation interviews Andros Payne on the corporate governance practices that underly sustainable value creation – the ‘G’ in ESG. We…

Read moreIn this 10 minute interview for Catalysis Advisory, Andros Payne of Humatica answers three important questions: What’s driving increased PE focus on non-financial, organizational issues in…

Read more

COVID-19 is forcing accelerated digitalisation of B2B sales with far-reaching consequences for Sales organisations. The rationale for on-site “sales calls” to understand customer needs and…

Read more

COVID-19 has taught us a lot about the organisational structures and new operating models of the future. One lesson is how much can actually be…

Read more

Many are speculating about what lasting organisational changes will result from COVID-19. Everyone is sure that social distancing will have an impact on how we…

Read more

As the fall-out from COVID-19 threatens to sink entire portfolios, PE sponsors and CEO’s need to walk a tightrope between preserving organisational capabilities in order…

Read more

At a time of heightened uncertainty, AI is creating even more future shock. Leading scientists, including the late Stephen Hawking warn that if left unchecked,…

Read more

The collective ability of an organisation to anticipate change, opportunities and risks, and move faster than the competition drives sustained value creation – the winning…

Read more

Markets, competition and customer preferences are shifting faster than ever. The disruptive economics of information is challenging new and established businesses alike. No wonder leaders…

Read more

As a long-time contributor to RealDeals magazine, Humatica was asked to write a piece on the future of private equity – a rare opportunity to…

Read more

Companies are reorganising more frequently than ever before. It’s a natural consequence of a more dynamic market environment and higher management turnover. Jack Welch famously…

Read more

As value creation plans have become more aggressive, the rate of CEO turnover has increased. Sponsors have less time and patience. But fire and hire…

Read more

In the June issue of Real Deals, the HumaticaCorner focuses on how some funds are turning new compliance requirements to their advantage for improved governance.…

Read more

Alvin Toffler, an American futurist, wrote his global best seller “Future Shock” in 1970 describing the effect of new technologies on business and society. His…

Read more

Digitalisation is one of the hottest topics in private equity today. The disruptive effect of the technology can render a good investment obsolete or enable…

Read more

The real test of a management team comes when they need to quickly shift from growth to cost reduction. This day of reckoning may soon…

Read more

PE executives are stuck between a rock and a hard spot. Pressure to drive company performance has increased with prices. On the other hand, the…

Read more

Over 70% of CEO’s are replaced during the holding period – one more indication of today’s challenging value creation plans and competitive deal markets. However, the…

Read more

Apple recently became the most valuable public company, breaking through the $1Tr. mark. How is it possible that a firm in the hyper-competitive consumer electronics…

Read more

As the PE industry matures and successful deals get trickier to execute, ESG guidance becomes more important. Compliance requirements are logically tightening all around. This…

Read more

At the recent PEI Operating Partners Forum Europe, there was consensus: organisational effectiveness and talent management are the foundation for implementing all value creation levers.…

Read more

Systems implementation is notorious for high project risk and failure to deliver anticipated benefits. In particular, private equity, with its limited timeline for investment, struggles…

Read more

With EBIT multiples reaching uncomfortable heights, there is no room for error in executing the value creation plan. And, management drives the pace. This month’s…

Read moreDigitalisation is disrupting business. But it is having an even more profound impact on organisations, behaviour and leadership. Rudimentary activities are being made redundant, and AI…

Read more

What got you there, won’t get you there Hyper-competitive deal markets and full-prices are changing the rules of the game. Private equity sponsors and portfolio…

Read more

One approach to boost yields is to target more complex, difficult situations. Corporate carve-outs often fit the profile. However, releasing value doesn’t come easy. Extracting…

Read more

The last year has seen a number of high-profile corporate carve-outs come to market. In a competitive buyout industry, private equity firms have been eager…

Read more

Times have been good for private equity since the global financial crisis in 2009 – eight years of steady growth and easy money. However, dealmakers…

Read moreMore funds are appointing specialised Operating Partners to help align portfolio company organisations for value growth. However, the emerging role is not yet well defined…

Read more

Increased competitiveness and technology are driving “always-on” availability of deal makers. However, is this a good thing? Humatica was recently quoted on the topic in…

Read more

Managing Secondaries – The good, the bad and the ugly Secondaries are more commonplace. However, a change of ownership from one PE house to the…

Read more

Over 50% of buy-out CEOs don’t get to see an investment all the way through. And, in private equity, the trend to replace senior executives…

Read moreIn the latest RealDeals Guest Comment article, Andros Payne, discusses learning the secret of how successful operating partners drive change without formal authority… Read full…

Read more

Based on a request from Limited Partners and General Partners, Humatica initiated an ambitious study to understand the current state of the art in organizational…

Read more

Operating Partners have the most difficult job in Private Equity. They should facilitate transformational change post-deal, but without formal authority. Our experience shows that those…

Read moreA lack of economic growth despite record low interest rates, rising populist discontent and mounting unfunded pension liabilities in the developed economies: they have the same…

Read more

Humatica has been an advocate for a more assertive PE investment approach focusing on leadership and organisational performance since 2003. In this month’s InFocus HR guru Dr.…

Read more

Women are running four of the world’s top democracies and with Hillary Clinton, may soon be running the fifth. Times have changed indeed. The ideals…

Read moreStandards and compliance requirements are increasing everywhere. However, the essential leadership processes for making and implementing decisions to grow value are often left to each…

Read more

Most people avoid conflict. It’s anti-social. However, sometimes this gets in the way of making good business decisions. This month’s InFocus features a recent interview with Ray Dalio,…

Read more“A well executed reorganisation can be one of the most liberating events in a company’s history, releasing power and talent”. In the latest edition of…

Read more97% of private equity investors confirm that personnel issues are a key reason for not achieving targeted IRR. Clearly, sponsors need more transparency in this…

Read more

“Specialisation runs out of steam when you can’t connect the dots on patterns of risk or opportunity, which is really what private equity is all about,” Read…

Read more

Private equity has grown in scale and maturity, with multi-billion funds having hundreds of employees and offering diverse financial services. In an era of diminishing…

Read more

Hiring the right people is frustratingly difficult. The number of dimensions on which there needs to be a fit are large. Some can be tested…

Read moreHiring the right people is frustratingly difficult. The number of dimensions on which there needs to be a fit are large. Some can be tested…

Read more

A recent article on growthbusiness.co.uk discusses the results from Humatica’s new study “The Third Wave: Organisational due diligence – Riding the next wave of value…

Read more

New Humatica Research Too many funds. Too much liquidity. Too high deal prices. Fund managers are asking themselves what’s next after Operational Excellence? How will…

Read more

In the October issue of Acquisition International Humatica consultant Valentina Pozzobon discusses how organisational due diligence can be incorporated successfully into business deals. “Considering merger…

Read more

Despite huge efforts to improve operational processes over the past 20 years, critically important management processes are left up to the discretion of each manager…

Read more

In an article published in last week’s issue of RealDeals Humatica’s Andros Payne explores what the Volkswagen value collapse says about knowledge worker behaviour, productivity…

Read more“GPs know that it is important to bring operational capabilities to their deals if they want to make stellar returns. But in overlooking the importance of soft factors they are missing out…

Read more

Volksvagen | VW Now, with the benefit of hindsight, it is a stupid surprise. How is it that a group of employees at VW could…

Read more

The transition into a new executive role in private equity is tough. The performance demands and rigour of private equity’s active governance model can be…

Read more

It is notoriously difficult for new buy-out CEOs to make the jump to private equity. The skills and competencies required to fulfil rigorous performance requirements are…

Read moreOperational processes have been re-engineered to perfection over the past 20 years. However, management decision-making processes that sit above them, are still left up to individual…

Read more

About the Interviewee NORMAN WALKER is an advisor to TPG Capital for portfolio company organisational and leadership issues. He leads his own firm Ardfern AG,…

Read more

Private equity’s governance structure places unique and high demands on senior executives. They are at the fulcrum of the capitalist system, balancing the requirements of…

Read more

All the easy levers have been pulled – purchasing cost reduction, a new strategy – so what’s next? Private equity sponsors are increasingly looking at…

Read more

What are the real reasons for roughly half of all mergers failing to generate their cost of capital? In the latest edition of Acquisition International…

Read more

Getting the culture right is critical for merger success. The greatest risk for failure is culture clash, a breakdown of trust, and the resulting stagnation. Merging…

Read more

Private equity leaders are faced with a massive challenge – how to grow revenues and value in slow-growth markets. Shifting white-collar productivity and improving behaviour…

Read more

The survival rate of private equity portfolio company CEOs is shockingly low. And the cost of changing the CEO in terms of lost time, effort and…

Read more

In the latest edition of Real Deals magazine Humatica’s Andros Payne contributes with his views on why the half-life of private equity-backed chief executives is…

Read more

Individual performance feedback is one of the toughest management processes to get right because it runs against the basic human nature of social interaction in…

Read more

Humatica’s CEO, Andros Payne, contributes his thoughts to the latest Merrill DataSite white paper on value creation across the private equity life cycle. Read the report…

Read more

Recent issue of PEI Operational Excellence: Keynote Interview with Erik Osmundsen, CEO of Altor’s portfolio company NorskGjenvinning and Andros Payne, Humatica The success of Altor’s…

Read moreIn today’s fast–moving markets, value creation comes from an organisation’s ability to collectively anticipate change, says Andros Payne, CEO of Humatica. More than a century…

Read more