As the PE industry matures and successful deals get trickier to execute, ESG guidance becomes more important. Compliance requirements are logically tightening all around.

This month’s InFocus features a recent Humatica article on how some funds are leveraging best-practice Governance to create superior returns.

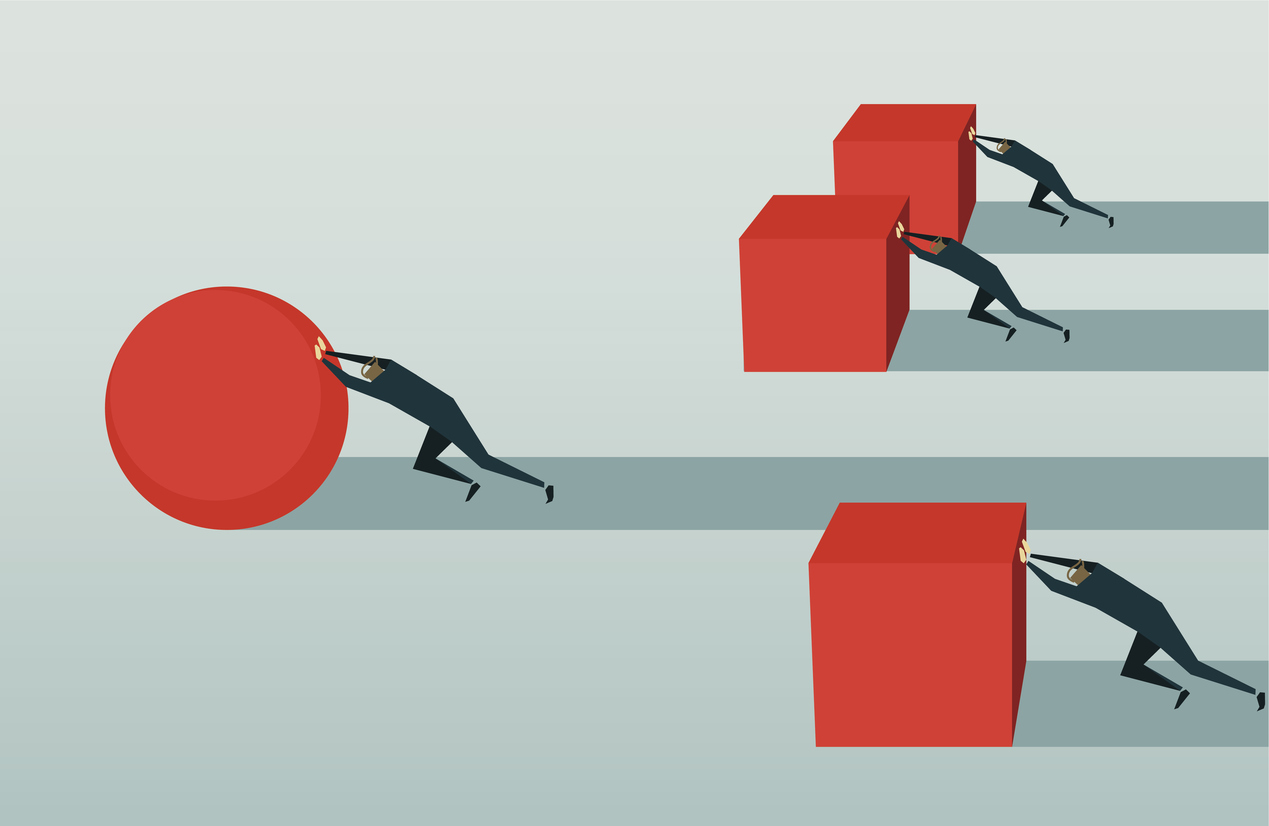

In many organizations, strategy promises growth, efficiency, and innovation—but day-to-day execution tells a different story. Decisions drag. Silos persist. Accountability blurs. Leaders work harder without…

Read more

In today’s private equity landscape, the classic levers of value creation are no longer enough. As markets evolve and competition intensifies, governance is emerging…

Read more

Measuring organizational performance is difficult, especially in a way that is both systematic and genuinely useful for decision-making. In a recent Alpha Talks conversation, Ueli…

Read moreErhalten Sie jeden Monat Neuigkeiten und wertvolle Perspektiven zu Themen der organisatorischen Effektivität